The basic premise of this strategy is to essentially cap your upside potential for an underlying asset, but in return you gain the ability to outperform an underlying asset on the downside:

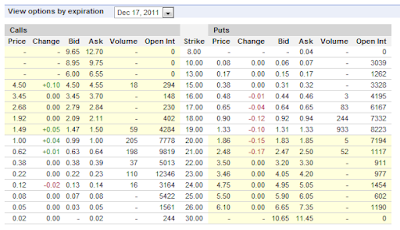

So if GE is currently selling for $19.42 and I want to cap an approximate 10% return on the stock at a price of around $21.36, I could buy 100 shares of GE and write one call option:

The $21 call option carries a premium of about $62-$63 per contract.

Scenarios:

- GE trades flat: you outperform GE because the option is not exercised

- GE trades above $21 strike: you cap a positive return of ($21 strike + premium collected) - $___ (price you paid for the stock)

- GE trades below your purchase price: option is not exercised so you outperform GE

- (% Loss on GE) + premium collected

This simple strategy does not take into account transaction costs which would definitely affect returns, but the premise remains the same.

Here is some evidence of the strategy actually employed on the market. PBP is a PowerShares buy/write ETF on the S&P 500.

This first chart is the comparative in a bear market:

PBP outperforms.

This second chart is for the bull market right after the bottom of the previous chart:

PBP underperforms.

This strategy is really a great test for prospect theory where it is said that losses hurt more than gains:

I believe in a way that this should be true. How else could Madoff build a $65B+ hedge fund premised on a strategy that was not supposed to outperform any indices in a bull market? Many people prefer the notion of safety and conservatism. The covered call strategy could be a definite choice for those individuals.

Nice recommendation ! The service provider is enough capable that he can fulfill the desires of individuals for the covered calls services offered at their website. The author had also described much about this service.

ReplyDelete