Via David Pinsen of seekingalpha.com (http://goo.gl/NLyye):

Majority Leader Cantor held "up to $15,000 in shares of the 2x levered ProShares Trust Ultrashort 20+ Year Treasury ETF (TBT)". That column quoted Cantor's spokesman as saying that Cantor held "a lot of Treasury debt", and that his TBT position merely hedged some of it.

Value Financial

A Value Investing Resource

RBCAA

I ran one my common value screens and found an interesting company in Republic Bancorp (RBCAA):

This company reminds me a lot of OZRK, which was a smaller regional bank I researched a couple years ago which has since performed quite well. RBCAA is currently yielding about 22% on its earnings and the company has grown its BV at almost 13% annually over the last 10 years.

Their dividend payout is only about 13.6% which could be higher and the company also has a high D/E of about 6.7. However, the underlying cash flow generation is solid for a smaller regional bank with a market cap of only $421m. RBCAA generated about $151m in FCF ttm.

It was also promising to see that the chairman founded the company many years ago and still oversees it with his family today.

From a valuation standpoint, the company currently sells for about $20.10. I ran my valuation calculator and it gave me a conservative price of about $46. This was assuming a 25% MOS and a 15% required return.

However attractive this company looks, I still have to research their 10-K's and delve deeper into the management's discussion. Also, it is a very volatile time to invest in the financial sector. Even though it is highly unlikely that a debt ceiling plan will not be passed, the present uncertainty could be more favorable for the patient investor to wait for a potentially stronger investment entry point.

This company reminds me a lot of OZRK, which was a smaller regional bank I researched a couple years ago which has since performed quite well. RBCAA is currently yielding about 22% on its earnings and the company has grown its BV at almost 13% annually over the last 10 years.

Their dividend payout is only about 13.6% which could be higher and the company also has a high D/E of about 6.7. However, the underlying cash flow generation is solid for a smaller regional bank with a market cap of only $421m. RBCAA generated about $151m in FCF ttm.

It was also promising to see that the chairman founded the company many years ago and still oversees it with his family today.

From a valuation standpoint, the company currently sells for about $20.10. I ran my valuation calculator and it gave me a conservative price of about $46. This was assuming a 25% MOS and a 15% required return.

However attractive this company looks, I still have to research their 10-K's and delve deeper into the management's discussion. Also, it is a very volatile time to invest in the financial sector. Even though it is highly unlikely that a debt ceiling plan will not be passed, the present uncertainty could be more favorable for the patient investor to wait for a potentially stronger investment entry point.

Tweedy, Browne 2010 Annual Report Stocks Highlights: LUK, JNJ, SYY, GLD, CSCO

From Guruhl: http://www.gurufocus.com/news/136283/tweedy-browne-2010-annual-report-stocks-highlights-luk-jnj-syy-gld-csco

Tweedy, Browne Company LLC is a value-oriented money management firm that bases itself on the principles of Ben Graham. They invest outside the United States using the same strategy of buying undervalued common stocks. They also look for companies with above-average dividend yields and an established history of paying dividends. The Tweedy, Browne Global Value Fund returned 10.59% over the year ended March 31, 2011.

Today they released their 2010 annual report in which they discussed the performance of several major stocks in their portfolio. Here are some excerpts:

Previously Held Stocks

Since our last report in September 2010, global equity markets have had quite a run. The MSCI World Index is up in double digits in both hedged and unhedged currency. Our Funds also did quite well during this period. Our returns in local currency, i.e., how our stocks performed independent of the impact of foreign currency, were driven in large part by continued strong returns in our branded consumer products companies. Most notable were tobacco stocks, such as Philip Morris International (PM) and British American Tobacco (BTI), and our food and beverage holdings, including Nestle (NSRGY), Diageo (DEO), Heineken (HINKF), and two of our Mexican Coca-Cola bottlers Embotelladoras Arca (AKO.A) and Contal, which announced that they were merging in January. Our financial stocks also produced very good returns during this period, more specifically, bank stocks such as Bangkok Bank and Bank of New York Mellon (BK); the publicly traded diversified holding company, Leucadia National (LUK); insurance holdings such as the large German reinsurer, Munich Re; the French life insurance company, CNP Assurances; the Swiss multi-line insurer, Zurich Financial; and the U.S.-based insurance broker, Brown & Brown (BRO). Our oil and gas stocks continued to produce strong returns as well, as oil prices continued to increase. As the global economy developed some momentum, several of our media and industrial holdings continued their rather robust recovery, including companies such as Axel Springer, the German publishing company; Gestevision Telecinco, the Spanish television broadcaster; Linde, the German industrial gas company; and Union Pacific (UNP), the U.S.-based Western rail company.

There were only a modest number of companies in our Funds' portfolios that produced negative returns over the last six months. This group included pharmaceutical holdings such as Novartis (NVS), Johnson & Johnson (JNJ), and Roche (RHHBY), and some of our Japanese and Korean holdings such as Canon (CAJ), T. Hasegawa, and Samchully. With rising concerns about their future pricing power and the expiration of patents, pharmaceutical companies these days trade in the stock market like utility stocks, i.e., at low price/earnings ratios and high dividend yields. Novartis, J&J and Roche all trade today around 10 to 12 times earnings and have dividend yields between 3.5% and 5%, but we believe characterizing them as utilities would be a mistake. Novartis and J&J have valuable consumer products businesses to complement their ethical drug businesses, and Roche, with its acquisition of Genentech, is the industry leader in biological pharmacology. None of these companies face the same patent cliffs of companies like Pfizer (PFE) and Eli Lilly (LLY), and all of them have exciting new drugs in their pipeline. We believe they should continue to grow as baby boomers move into retirement, and we are being paid a very attractive and growing dividend while we wait for market sentiment to change.

Our rather modest position in Japanese stocks produced solid returns since our last report despite a relatively small decline at quarter end due in large part to the tragic earthquake and its nuclear aftermath. The Japanese situation is unfolding, and still quite uncertain. The potential for electrical power shortages and the implications it has for production are serious concerns, along with the impact on Japanese consumer consumption. That said, our exposure is reasonable, and we are comfortable with the investments we have made. The majority of our Japanese exposure is in companies that are major exporters, which leaves them less dependent upon domestic demand. The next couple of quarters will be difficult, but the resilience of the Japanese people and their industries over the longer term has been enviable.

New Portfolio Additions

SEC Carbon, which manufactures electrodes used in steel furnaces and cathodes for aluminum smelting facilities in addition to other industrial materials, is a Japanese small cap stock that at purchase was trading at 58% of book value and at roughly 6 times earnings, assuming the company could continue to earn 9% on its book value. In excess of 60% of its sales are for export and the company has practically no net debt.

G4S Plc, based in the UK, is the world's leading international security group offering security services in a number of categories, including security guards, alarms, prison management, cash and valuables transportation, among others. It generates high free cash flow, has significant exposure to faster growing emerging markets, has paid a dividend yield north of 3%, and trades at a discount from estimated intrinsic value. It is one of the few security companies that can handle the diverse and often global needs of large corporations and governments.

Cisco Systems (CSCO) provides routing, data and networking products for the internet globally, and has an overwhelming market share in routers and switches. No, this is not a typo, but rather Tweedy, Browne's first purchase of a technology stock in quite some time. You probably can recall when Cisco was trading in late 1999 and early 2000 at 140 times earnings, and had become the largest company in the world, based on a market capitalization in excess of $500 billion. In contrast, at I-4 roughly $17 to $18 per share today, the stock is trading at roughly 13 times trailing earnings and 11 times 2011 estimates. If you were to strip out the $45 billion of cash and short-term investments on the balance sheet, the P/E ex the cash would be even a point or more lower. Cisco controls 58% of the market for routers and 64% of the market for switches, and as a result the costs incurred when moving to a competitor's product remain high. It has created an additional barrier to entry through a sales channel that is financed by and tightly bound to the company. It throws off a lot of free cash flow, and projected growth in routing and switching remains strong as internet traffic continues to increase at a frenetic pace. The company has been aggressively buying in its stock, has reduced its reliance on stock options as a means of compensation, and recently began paying a dividend. It has a dominant market position, and is growing within a category that we believe still has a lot of room for future growth. Perceived competitive threats and concerns about possible slower rates of growth have put pressure on Cisco's stock price, which has allowed us an entry point in the stock that we believe is at roughly a one-third discount from a conservative estimate of the company's intrinsic value, which we would estimate to be about $26 per share. Again, the potential for product obsolescence is always greater for a company like Cisco than for a company like Nestle. That said, we don't believe it is going to disappear anytime soon, and we feel we are being offered a price today in the market that more than compensates us for the risks we are taking. We believe it's worth a 1% to 2% bet in the Value Fund's portfolio.

Lockheed Martin (LMT) is the world's largest defense contractor. Around year end, we purchased shares in Lockheed Martin for the Worldwide High Dividend Yield Value Fund. It has what we think is a highly desirable product mix (F-35s, missile defense, cyber security) and limited exposure to supplemental defense spending, which will most likely be under pressure going forward due to government budget issues. At purchase, it was trading at roughly 10 times earnings, with a solid free cash flow yield excluding pensions of 12% to 13%. It had a dividend yield of 4.2%, and has a record of returning another 1% to 2% (per quarter) to shareholders in the form of stock buybacks. The dividend has increased by 10% or more over the last eight consecutive years, and the payout ratio is a conservative 42%.

Added Pre-Existing Stocks

In addition to these new purchases, we also added to several of our pre-existing positions since our last report including Roche, Provident Financial (PFS), SK Gas, Zurich Financial, Wells Fargo (WFC), British American Tobacco (BTI), Kimberly Clark (KMB), Mediaset, Total, and Exelon (EXC), among others.

Sells

Notable sales since our last report included Home Depot (HD), Edipresse, Grupo Minerali, and Korea Exchange Bank. We trimmed our position in a number of holdings including Axel Springer, Compagnie Financière Richemont (CFRUY), Coca-Cola Femsa (KOF), Embotteladoras Arca, Comcast (CCT), Emerson Electric (EMR), Henkel (HENKY), Krones and Linde, among others.

Sysco Corporation (SYY)

We have often referred to many of the better businesses in which we have invested as "financial Suburbans," companies we believe can withstand virtually any economic headwinds or "accidents" that come their way. In part, this has to do with the very nature of their businesses, but also with the way they respond in a crisis. We think Sysco, which we hold in the Tweedy, Browne Worldwide High Dividend Yield Value Fund, is an example of a financial Suburban.

Sysco Corporation is the undisputed leader in the food service distribution industry in the U.S. and Canada. It is approximately twice the size of the next closest competitor. The company has a diverse mix of over 400,000 customers. While the core customers are restaurants, the company also sells to hospitals, schools and hotels, among others. With over 360,000 products, Sysco has the largest breadth of products provided by any food service distributor in North America.

Tweedy, Browne first purchased shares in Sysco Corporation for the Worldwide High Dividend Yield Value Fund during the summer of 2009. Our average purchase price was $22.77 per share. At this average price, we were paying 7.9x current enterprise value (the company's market capitalization plus any debt minus cash) ("EV") to EBIT, 6.6x EV to earnings before interest, taxes, depreciation, and amortization ("EBITDA") and approximately 13x net income. At purchase, the annual dividend yield was approximately 4.2%. Sysco also had a strong balance sheet with modest debt leverage (rated AA- by S&P).

We observed over the last decade that large food service distributors had been acquired for 13x to 15x EBIT and 9x to 12x EBITDA. Due to its industry-leading position and size, Sysco is highly unlikely to ever be acquired by either a strategic or financial buyer. Therefore, in order to be conservative, we derived an intrinsic value estimate of Sysco using 11x EBIT, or 9.2x EBITDA. After subtracting the net debt and adjusting for a potential IRS tax settlement, we estimated that Sysco was worth approximately $30 per share. Therefore, at an average purchase price of $22.77, we believed we were paying approximately 76% of appraised value. While not a large enough price discount to intrinsic value (24% discount) to qualify for inclusion in our traditional portfolios, at 76% of intrinsic value with a 4.2% dividend yield, it more than qualified for inclusion in our high dividend yield portfolios.

In our opinion, Sysco is a business, to borrow a description often used by Warren Buffett, with a "wide moat," which serves to better protect the business from competitors. Sysco's competitive advantages include its overall size, its strong local customer relationships, its ability to successfully execute logistics and supply chain management, its history of superior customer service, its large inventory of offered products, and a large sales force of approximately 8,000.

While Sysco seems to have clear qualitative competitive advantages, its historical financial track record validates the strength of those advantages. At our time of initial purchase, Sysco had gained an average of 50 basis points of market share per year through acquisitions and organic growth; it had increased revenue for 38 consecutive years; increased net income in almost every year; paid a dividend for 41 straight years and increased the dividend for 32 straight years; it had a history of earning steady margins (an EBIT margin around 5%), which were approximately double what the competition earned; and over the prior decade earned an average Return on Equity (ROE) of 31%.

The majority of Sysco's revenue and profits are derived from restaurants. With consumer spending declining during the recent economic downturn, which resulted in a significant decrease in spending at restaurants, Sysco and its competitors faced the worst business environment that the company had seen in 40 years of operating the business. Faced with these challenges, Sysco cut fixed costs aggressively through workforce reductions in line with case volume declines. Margins were also supported by falling variable expenses such as employee bonuses and sales commissions. Sysco also cut capital expenditures plans and reduced share repurchases to conserve cash (despite having a superb balance sheet). Eventually, as time passed, consumer confidence began to improve and case volume growth (and sales) returned to positive levels.

Despite the doom and gloom at initial purchase, the numbers above illustrate how little impact the Great Recession had on Sysco's sales and earnings. In fact, based on our updated appraisal today of $33 per share, we believe that Sysco has increased its intrinsic value since our initial purchase in the summer of 2009 (excluding generous dividends earned since purchase).

At today's price of $28.50, the stock is up 30% from our initial original cost, yet still trades at a discount from our estimate of its intrinsic value of $33 and the outlook, in our view, remains positive. Sysco is embarking on a major Enterprise Resource Planning (ERP) project whose implementation is expected to cost $900 million over the next 5 years. The cost of this project will likely hold back earnings growth in 2011 and 2012. However, from our perspective, it seems that the company is making investments that will ultimately result in higher long-term earnings power. In fact, Sysco management recently committed to the goal of delivering EPS of $3.00 per share by fiscal 2015. Compared to the fiscal 2010 level of $1.94 per share, this represents a 5-year I-7 compounded annual growth rate of +9.1%. Assuming no multiple expansion, and including dividends (the current dividend yield is 3.5%), it does not seem to be a stretch that Sysco can compound shareholders' money at a double digit rate over the next 5 years. That said, Sysco is a diversified bet (1.4% position) that we have made in our dividend Fund. It is impossible to know today whether the stock will work out well for us in the years ahead, but the probabilities certainly appear to be in our favor with a company like Sysco.

Gold (GLD)

Not since the late 1970s has the lust for gold by investors been as great as it has been recently. We thought we would take a brief moment to comment on this phenomenon, lest you feel we were missing the boat by not socking away some of your hard earned capital in this seductive commodity. Inflation fearing investors have been feverishly buying up gold commodity futures, gold coins, gold stocks, gold ETFs and, in some instances, the bullion itself. The price of gold on the commodity futures exchange is up almost 75% since the onset of the financial crisis in the fall of 2007. Some well known and highly followed hedge fund managers have been building large positions in gold.

We believe there are better ways to address economic uncertainties than to speculate in a commodity that produces nothing in the way of income, costs money to store, and whose value is completely dependent on investors' continued faith in it. With no underlying cash flow available to support a valuation, calculating an intrinsic value for gold is virtually impossible. We also think that gold's effectiveness as an inflation hedge has been nothing to write home about. Ben Graham commented on this in his book, The Intelligent Investor, in 1973. Gold did subsequently appreciate significantly in the late '70s in correlation with our last serious bout of inflation, but like most commodities in general, it has been pretty much a "do nothing" investment ever since, at least up until the last 18 months. From its previous peak in 1980 of $667 per ounce to its current price of roughly $1,500 per ounce, gold has compounded at approximately 2.7% per year versus 3.2% for the Consumer Price Index. On the other hand, common stocks, as measured by the performance of the S&P 500, compounded at an annual rate of approximately 11%, including dividends, over this 30-year period.

When asked about gold in a recent interview, Warren Buffett had this cautionary observation about the value of gold at today's prices.

You could take all the gold that's ever been mined, and it would fill a cube 67 feet in each direction. For what that's worth at current gold prices, you could buy all — not some — all of the farmland in the United States. Plus, you could buy 10 Exxon Mobils, plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?

Enough said!

Tweedy, Browne Company LLC is a value-oriented money management firm that bases itself on the principles of Ben Graham. They invest outside the United States using the same strategy of buying undervalued common stocks. They also look for companies with above-average dividend yields and an established history of paying dividends. The Tweedy, Browne Global Value Fund returned 10.59% over the year ended March 31, 2011.

Today they released their 2010 annual report in which they discussed the performance of several major stocks in their portfolio. Here are some excerpts:

Previously Held Stocks

Since our last report in September 2010, global equity markets have had quite a run. The MSCI World Index is up in double digits in both hedged and unhedged currency. Our Funds also did quite well during this period. Our returns in local currency, i.e., how our stocks performed independent of the impact of foreign currency, were driven in large part by continued strong returns in our branded consumer products companies. Most notable were tobacco stocks, such as Philip Morris International (PM) and British American Tobacco (BTI), and our food and beverage holdings, including Nestle (NSRGY), Diageo (DEO), Heineken (HINKF), and two of our Mexican Coca-Cola bottlers Embotelladoras Arca (AKO.A) and Contal, which announced that they were merging in January. Our financial stocks also produced very good returns during this period, more specifically, bank stocks such as Bangkok Bank and Bank of New York Mellon (BK); the publicly traded diversified holding company, Leucadia National (LUK); insurance holdings such as the large German reinsurer, Munich Re; the French life insurance company, CNP Assurances; the Swiss multi-line insurer, Zurich Financial; and the U.S.-based insurance broker, Brown & Brown (BRO). Our oil and gas stocks continued to produce strong returns as well, as oil prices continued to increase. As the global economy developed some momentum, several of our media and industrial holdings continued their rather robust recovery, including companies such as Axel Springer, the German publishing company; Gestevision Telecinco, the Spanish television broadcaster; Linde, the German industrial gas company; and Union Pacific (UNP), the U.S.-based Western rail company.

There were only a modest number of companies in our Funds' portfolios that produced negative returns over the last six months. This group included pharmaceutical holdings such as Novartis (NVS), Johnson & Johnson (JNJ), and Roche (RHHBY), and some of our Japanese and Korean holdings such as Canon (CAJ), T. Hasegawa, and Samchully. With rising concerns about their future pricing power and the expiration of patents, pharmaceutical companies these days trade in the stock market like utility stocks, i.e., at low price/earnings ratios and high dividend yields. Novartis, J&J and Roche all trade today around 10 to 12 times earnings and have dividend yields between 3.5% and 5%, but we believe characterizing them as utilities would be a mistake. Novartis and J&J have valuable consumer products businesses to complement their ethical drug businesses, and Roche, with its acquisition of Genentech, is the industry leader in biological pharmacology. None of these companies face the same patent cliffs of companies like Pfizer (PFE) and Eli Lilly (LLY), and all of them have exciting new drugs in their pipeline. We believe they should continue to grow as baby boomers move into retirement, and we are being paid a very attractive and growing dividend while we wait for market sentiment to change.

Our rather modest position in Japanese stocks produced solid returns since our last report despite a relatively small decline at quarter end due in large part to the tragic earthquake and its nuclear aftermath. The Japanese situation is unfolding, and still quite uncertain. The potential for electrical power shortages and the implications it has for production are serious concerns, along with the impact on Japanese consumer consumption. That said, our exposure is reasonable, and we are comfortable with the investments we have made. The majority of our Japanese exposure is in companies that are major exporters, which leaves them less dependent upon domestic demand. The next couple of quarters will be difficult, but the resilience of the Japanese people and their industries over the longer term has been enviable.

New Portfolio Additions

SEC Carbon, which manufactures electrodes used in steel furnaces and cathodes for aluminum smelting facilities in addition to other industrial materials, is a Japanese small cap stock that at purchase was trading at 58% of book value and at roughly 6 times earnings, assuming the company could continue to earn 9% on its book value. In excess of 60% of its sales are for export and the company has practically no net debt.

G4S Plc, based in the UK, is the world's leading international security group offering security services in a number of categories, including security guards, alarms, prison management, cash and valuables transportation, among others. It generates high free cash flow, has significant exposure to faster growing emerging markets, has paid a dividend yield north of 3%, and trades at a discount from estimated intrinsic value. It is one of the few security companies that can handle the diverse and often global needs of large corporations and governments.

Cisco Systems (CSCO) provides routing, data and networking products for the internet globally, and has an overwhelming market share in routers and switches. No, this is not a typo, but rather Tweedy, Browne's first purchase of a technology stock in quite some time. You probably can recall when Cisco was trading in late 1999 and early 2000 at 140 times earnings, and had become the largest company in the world, based on a market capitalization in excess of $500 billion. In contrast, at I-4 roughly $17 to $18 per share today, the stock is trading at roughly 13 times trailing earnings and 11 times 2011 estimates. If you were to strip out the $45 billion of cash and short-term investments on the balance sheet, the P/E ex the cash would be even a point or more lower. Cisco controls 58% of the market for routers and 64% of the market for switches, and as a result the costs incurred when moving to a competitor's product remain high. It has created an additional barrier to entry through a sales channel that is financed by and tightly bound to the company. It throws off a lot of free cash flow, and projected growth in routing and switching remains strong as internet traffic continues to increase at a frenetic pace. The company has been aggressively buying in its stock, has reduced its reliance on stock options as a means of compensation, and recently began paying a dividend. It has a dominant market position, and is growing within a category that we believe still has a lot of room for future growth. Perceived competitive threats and concerns about possible slower rates of growth have put pressure on Cisco's stock price, which has allowed us an entry point in the stock that we believe is at roughly a one-third discount from a conservative estimate of the company's intrinsic value, which we would estimate to be about $26 per share. Again, the potential for product obsolescence is always greater for a company like Cisco than for a company like Nestle. That said, we don't believe it is going to disappear anytime soon, and we feel we are being offered a price today in the market that more than compensates us for the risks we are taking. We believe it's worth a 1% to 2% bet in the Value Fund's portfolio.

Lockheed Martin (LMT) is the world's largest defense contractor. Around year end, we purchased shares in Lockheed Martin for the Worldwide High Dividend Yield Value Fund. It has what we think is a highly desirable product mix (F-35s, missile defense, cyber security) and limited exposure to supplemental defense spending, which will most likely be under pressure going forward due to government budget issues. At purchase, it was trading at roughly 10 times earnings, with a solid free cash flow yield excluding pensions of 12% to 13%. It had a dividend yield of 4.2%, and has a record of returning another 1% to 2% (per quarter) to shareholders in the form of stock buybacks. The dividend has increased by 10% or more over the last eight consecutive years, and the payout ratio is a conservative 42%.

Added Pre-Existing Stocks

In addition to these new purchases, we also added to several of our pre-existing positions since our last report including Roche, Provident Financial (PFS), SK Gas, Zurich Financial, Wells Fargo (WFC), British American Tobacco (BTI), Kimberly Clark (KMB), Mediaset, Total, and Exelon (EXC), among others.

Sells

Notable sales since our last report included Home Depot (HD), Edipresse, Grupo Minerali, and Korea Exchange Bank. We trimmed our position in a number of holdings including Axel Springer, Compagnie Financière Richemont (CFRUY), Coca-Cola Femsa (KOF), Embotteladoras Arca, Comcast (CCT), Emerson Electric (EMR), Henkel (HENKY), Krones and Linde, among others.

Sysco Corporation (SYY)

We have often referred to many of the better businesses in which we have invested as "financial Suburbans," companies we believe can withstand virtually any economic headwinds or "accidents" that come their way. In part, this has to do with the very nature of their businesses, but also with the way they respond in a crisis. We think Sysco, which we hold in the Tweedy, Browne Worldwide High Dividend Yield Value Fund, is an example of a financial Suburban.

Sysco Corporation is the undisputed leader in the food service distribution industry in the U.S. and Canada. It is approximately twice the size of the next closest competitor. The company has a diverse mix of over 400,000 customers. While the core customers are restaurants, the company also sells to hospitals, schools and hotels, among others. With over 360,000 products, Sysco has the largest breadth of products provided by any food service distributor in North America.

Tweedy, Browne first purchased shares in Sysco Corporation for the Worldwide High Dividend Yield Value Fund during the summer of 2009. Our average purchase price was $22.77 per share. At this average price, we were paying 7.9x current enterprise value (the company's market capitalization plus any debt minus cash) ("EV") to EBIT, 6.6x EV to earnings before interest, taxes, depreciation, and amortization ("EBITDA") and approximately 13x net income. At purchase, the annual dividend yield was approximately 4.2%. Sysco also had a strong balance sheet with modest debt leverage (rated AA- by S&P).

We observed over the last decade that large food service distributors had been acquired for 13x to 15x EBIT and 9x to 12x EBITDA. Due to its industry-leading position and size, Sysco is highly unlikely to ever be acquired by either a strategic or financial buyer. Therefore, in order to be conservative, we derived an intrinsic value estimate of Sysco using 11x EBIT, or 9.2x EBITDA. After subtracting the net debt and adjusting for a potential IRS tax settlement, we estimated that Sysco was worth approximately $30 per share. Therefore, at an average purchase price of $22.77, we believed we were paying approximately 76% of appraised value. While not a large enough price discount to intrinsic value (24% discount) to qualify for inclusion in our traditional portfolios, at 76% of intrinsic value with a 4.2% dividend yield, it more than qualified for inclusion in our high dividend yield portfolios.

In our opinion, Sysco is a business, to borrow a description often used by Warren Buffett, with a "wide moat," which serves to better protect the business from competitors. Sysco's competitive advantages include its overall size, its strong local customer relationships, its ability to successfully execute logistics and supply chain management, its history of superior customer service, its large inventory of offered products, and a large sales force of approximately 8,000.

While Sysco seems to have clear qualitative competitive advantages, its historical financial track record validates the strength of those advantages. At our time of initial purchase, Sysco had gained an average of 50 basis points of market share per year through acquisitions and organic growth; it had increased revenue for 38 consecutive years; increased net income in almost every year; paid a dividend for 41 straight years and increased the dividend for 32 straight years; it had a history of earning steady margins (an EBIT margin around 5%), which were approximately double what the competition earned; and over the prior decade earned an average Return on Equity (ROE) of 31%.

The majority of Sysco's revenue and profits are derived from restaurants. With consumer spending declining during the recent economic downturn, which resulted in a significant decrease in spending at restaurants, Sysco and its competitors faced the worst business environment that the company had seen in 40 years of operating the business. Faced with these challenges, Sysco cut fixed costs aggressively through workforce reductions in line with case volume declines. Margins were also supported by falling variable expenses such as employee bonuses and sales commissions. Sysco also cut capital expenditures plans and reduced share repurchases to conserve cash (despite having a superb balance sheet). Eventually, as time passed, consumer confidence began to improve and case volume growth (and sales) returned to positive levels.

Despite the doom and gloom at initial purchase, the numbers above illustrate how little impact the Great Recession had on Sysco's sales and earnings. In fact, based on our updated appraisal today of $33 per share, we believe that Sysco has increased its intrinsic value since our initial purchase in the summer of 2009 (excluding generous dividends earned since purchase).

At today's price of $28.50, the stock is up 30% from our initial original cost, yet still trades at a discount from our estimate of its intrinsic value of $33 and the outlook, in our view, remains positive. Sysco is embarking on a major Enterprise Resource Planning (ERP) project whose implementation is expected to cost $900 million over the next 5 years. The cost of this project will likely hold back earnings growth in 2011 and 2012. However, from our perspective, it seems that the company is making investments that will ultimately result in higher long-term earnings power. In fact, Sysco management recently committed to the goal of delivering EPS of $3.00 per share by fiscal 2015. Compared to the fiscal 2010 level of $1.94 per share, this represents a 5-year I-7 compounded annual growth rate of +9.1%. Assuming no multiple expansion, and including dividends (the current dividend yield is 3.5%), it does not seem to be a stretch that Sysco can compound shareholders' money at a double digit rate over the next 5 years. That said, Sysco is a diversified bet (1.4% position) that we have made in our dividend Fund. It is impossible to know today whether the stock will work out well for us in the years ahead, but the probabilities certainly appear to be in our favor with a company like Sysco.

Gold (GLD)

Not since the late 1970s has the lust for gold by investors been as great as it has been recently. We thought we would take a brief moment to comment on this phenomenon, lest you feel we were missing the boat by not socking away some of your hard earned capital in this seductive commodity. Inflation fearing investors have been feverishly buying up gold commodity futures, gold coins, gold stocks, gold ETFs and, in some instances, the bullion itself. The price of gold on the commodity futures exchange is up almost 75% since the onset of the financial crisis in the fall of 2007. Some well known and highly followed hedge fund managers have been building large positions in gold.

We believe there are better ways to address economic uncertainties than to speculate in a commodity that produces nothing in the way of income, costs money to store, and whose value is completely dependent on investors' continued faith in it. With no underlying cash flow available to support a valuation, calculating an intrinsic value for gold is virtually impossible. We also think that gold's effectiveness as an inflation hedge has been nothing to write home about. Ben Graham commented on this in his book, The Intelligent Investor, in 1973. Gold did subsequently appreciate significantly in the late '70s in correlation with our last serious bout of inflation, but like most commodities in general, it has been pretty much a "do nothing" investment ever since, at least up until the last 18 months. From its previous peak in 1980 of $667 per ounce to its current price of roughly $1,500 per ounce, gold has compounded at approximately 2.7% per year versus 3.2% for the Consumer Price Index. On the other hand, common stocks, as measured by the performance of the S&P 500, compounded at an annual rate of approximately 11%, including dividends, over this 30-year period.

When asked about gold in a recent interview, Warren Buffett had this cautionary observation about the value of gold at today's prices.

You could take all the gold that's ever been mined, and it would fill a cube 67 feet in each direction. For what that's worth at current gold prices, you could buy all — not some — all of the farmland in the United States. Plus, you could buy 10 Exxon Mobils, plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?

Enough said!

Update: LNKD

A comparable P/E within the technology sector could be somewhere between 18-30 (18.62 is the avg for the tech sector from yahoo finance). With a more generous P/E of 30, LNKD would have to have EPS of $2.94 to justify a price of $88.32. That is a 7260% total growth in EPS. Over a period of 10 years, this would be a CAGR of 54%. Over a 15 year period, this would equate to a 33.19% CAGR.

This is also not taking into account the likeliness of price appreciation of the shares which would drive up the needed justifiable percentage growth rate in earnings.

Will be interesting to see the future of LNKD's valuation.

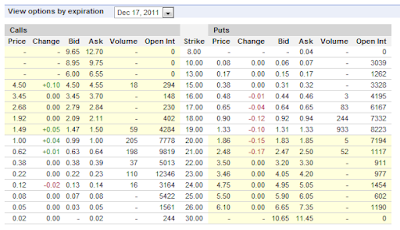

Covered Call Strategy

I was speaking to a friend today about different options strategies and we discussed the covered call. I believe that this was similar to the strategy that Bernie Madoff had promised investors he was employing for many years. It is a conservative and very useful strategy, so I thought I would outline our thinking on how to utilize it.

The basic premise of this strategy is to essentially cap your upside potential for an underlying asset, but in return you gain the ability to outperform an underlying asset on the downside:

So if GE is currently selling for $19.42 and I want to cap an approximate 10% return on the stock at a price of around $21.36, I could buy 100 shares of GE and write one call option:

The $21 call option carries a premium of about $62-$63 per contract.

Scenarios:

PBP underperforms.

This strategy is really a great test for prospect theory where it is said that losses hurt more than gains:

I believe in a way that this should be true. How else could Madoff build a $65B+ hedge fund premised on a strategy that was not supposed to outperform any indices in a bull market? Many people prefer the notion of safety and conservatism. The covered call strategy could be a definite choice for those individuals.

The basic premise of this strategy is to essentially cap your upside potential for an underlying asset, but in return you gain the ability to outperform an underlying asset on the downside:

So if GE is currently selling for $19.42 and I want to cap an approximate 10% return on the stock at a price of around $21.36, I could buy 100 shares of GE and write one call option:

The $21 call option carries a premium of about $62-$63 per contract.

Scenarios:

- GE trades flat: you outperform GE because the option is not exercised

- GE trades above $21 strike: you cap a positive return of ($21 strike + premium collected) - $___ (price you paid for the stock)

- GE trades below your purchase price: option is not exercised so you outperform GE

- (% Loss on GE) + premium collected

This simple strategy does not take into account transaction costs which would definitely affect returns, but the premise remains the same.

Here is some evidence of the strategy actually employed on the market. PBP is a PowerShares buy/write ETF on the S&P 500.

This first chart is the comparative in a bear market:

PBP outperforms.

This second chart is for the bull market right after the bottom of the previous chart:

PBP underperforms.

This strategy is really a great test for prospect theory where it is said that losses hurt more than gains:

I believe in a way that this should be true. How else could Madoff build a $65B+ hedge fund premised on a strategy that was not supposed to outperform any indices in a bull market? Many people prefer the notion of safety and conservatism. The covered call strategy could be a definite choice for those individuals.

Subscribe to:

Comments (Atom)